Monthly Budget Worksheet

FULLY CUSTOMIZABLE**

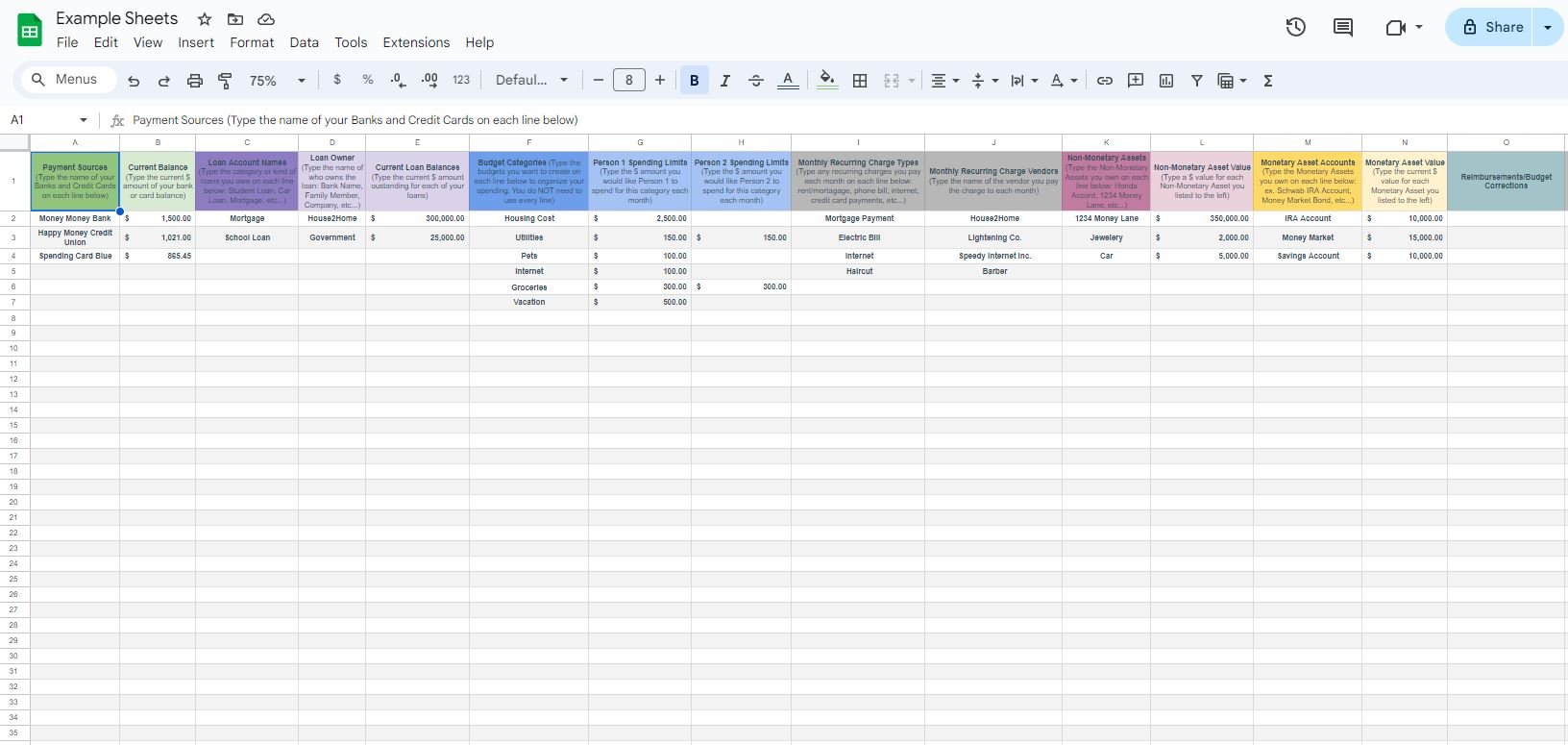

Introducing the ultimate solution to manage your finances effectively - our Personalized Budget Worksheet with Monthly Tabs! Take control of your expenses, savings, and financial goals like never before with this meticulously designed, user-friendly worksheet. This is a GOOGLE SHEETS download. You will need to utilize a Google Account with this worksheet.

Each month is conveniently organized into separate tabs, allowing you to track and plan your budget with ease. Customizable fields enable you to input your income, expenses, savings targets, and debts, providing a clear snapshot of your financial standing every month.

Key Features:

1. Monthly Tabs: Easily navigate between months to monitor and analyze your finances month-by-month.

2. Customizable Fields: Tailor the worksheet to fit your specific financial situation by inputting your income, expenses, savings, and debts.

3. Comprehensive Tracking: Monitor spending patterns, set achievable saving goals, and track progress towards financial milestones.

4. User-Friendly Design: Simple and intuitive layout for effortless budget planning and management.

5. Personalized Solution: Adapt the worksheet to your unique financial needs and goals.

Our Personalized Budget Worksheet also includes a powerful carry-over feature that ensures seamless budgeting from one month to the next. This feature automatically transfers unspent amounts or overspent categories into the following month’s budget, allowing for more accurate tracking and adjustment of your finances. Whether you have leftover savings or exceeded your budget in certain areas, the worksheet adapts accordingly, ensuring that nothing is missed. This helps you stay on top of your financial goals and provides a realistic view of how your spending and saving habits evolve over time.

Why Choose Our Personalized Budget Worksheet?

- Empowers you to take charge of your finances by providing a clear, organized, and practical budgeting tool.

- Helps you stay accountable and motivated towards achieving financial stability and goals.

- Encourages smart financial decisions by offering a structured overview of your income and expenses.

Whether you're aiming to save for a vacation, pay off debts, or simply gain better control of your finances, our Personalized Budget Worksheet with Monthly Tabs is the tool you need for financial success. Invest in your financial well-being today and experience the peace of mind that comes with effective budget management!

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

Here's how using our worksheet can propel you towards your goals:

1. Clarity and Organization: Gain a crystal-clear understanding of your financial landscape. Categorize and monitor your income and expenses on a month-to-month basis, providing a structured overview of where your money goes.

2. Goal Setting and Tracking: Set achievable financial objectives - be it saving for a down payment, creating an emergency fund, or paying off debts. Our worksheet allows you to set these goals and track your progress over time. Witnessing your accomplishments each month is a powerful motivator.

3. Identifying Saving Opportunities: Pinpoint areas where you can cut unnecessary expenses or allocate more funds toward your goals. Visualizing your spending habits empowers you to make informed decisions about where to save or invest.

4. Budget Optimization: Fine-tune your budgeting strategy based on real-time data. Analyze trends, identify patterns, and make adjustments to ensure you're consistently moving closer to your financial targets.

5. Financial Awareness and Discipline: By regularly updating the worksheet, you cultivate a habit of financial mindfulness. This awareness helps you steer clear of impulsive spending and reinforces disciplined money management.

6. Building Financial Confidence: As you watch your progress unfold, you'll feel more confident and in control of your financial journey. This newfound confidence will drive you towards achieving even loftier financial goals.

By utilizing our Personalized Budget Worksheet with Monthly Tabs, you're not just managing numbers; you're taking deliberate steps towards financial empowerment. The structured approach offered by our worksheet acts as a roadmap guiding you towards financial success. Start your journey today and witness the transformative power of effective financial planning!

Concerned about security and privacy while managing your finances? Our Personalized Budget Worksheet with Monthly Tabs offers a safe and reliable alternative to app-based financial tracking, ensuring complete control without the need to connect to any financial institutions.

Here's why using our worksheet can be a safer way to track your expenses:

1. No External Connections: Unlike apps that often require linking to your bank accounts or financial institutions, our worksheet operates independently. You have full control over your financial data, eliminating any potential security risks associated with external connections.

2. Enhanced Privacy: Your financial information remains strictly within your hands. There's no exposure to third-party apps or external servers, reducing the chances of data breaches or unauthorized access to your sensitive financial details.

3. Offline Accessibility: Our worksheet operates offline, ensuring that your financial information stays secure on your personal device. You won't be dependent on an internet connection or worry about potential vulnerabilities that come with cloud-based services.

4. Customized Security Measures: You can implement your own security measures when using the worksheet, such as password protection or storing it in a secure location. This adds an extra layer of security tailored to your comfort level.

5. Peace of Mind: With no connectivity to external financial systems, you have peace of mind knowing that your financial data is solely in your control. There's no risk of data exposure due to breaches in third-party systems.

Our Personalized Budget Worksheet offers a safe and practical way to manage your finances without compromising on security. By opting for this offline method, you retain complete authority over your financial information, ensuring a secure and private approach to tracking expenses and achieving your financial goals.

Experience seamless and efficient budget management with our Personalized Budget Worksheet featuring advanced formatting capabilities designed to streamline your financial planning effortlessly from month to month.

Here's how our advanced formatting can automate budget inputs:

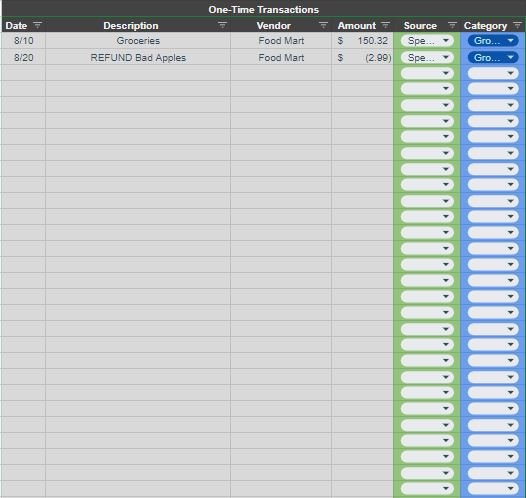

1. Formula Automation: Forget manual calculations! Our worksheet comes equipped with pre-built formulas that automatically calculate totals, percentages, and averages. Simply input your income, expenses, and savings data in designated fields, and let the worksheet do the math for you.

2. Recurring Expense Templates: Streamline your budgeting process by setting up recurring expense templates. Easily duplicate recurring monthly expenses with a simple copy-and-paste action. This feature saves time by eliminating the need to re-enter the same expenses each month.

3. Dynamic Data Transfer: Link data between tabs or sections within the worksheet. For instance, your total expenses from the previous month can automatically transfer to the following month's budget, providing a seamless continuity in tracking your finances.

4. Conditional Formatting: Set up conditional formatting rules to visually highlight specific criteria. For instance, expenses exceeding a certain threshold can be color-coded to draw attention, ensuring you're aware of significant expenses at a glance.

5. Goal Tracking and Progress Visualization: Utilize progress bars or visual indicators to track your progress towards financial goals. These visual aids offer a clear representation of how close you are to achieving specific milestones, keeping you motivated and focused.

6. Data Validation and Drop-down Menus: Ensure data accuracy and consistency by implementing drop-down menus and data validation. This feature minimizes errors and ensures that only valid inputs are accepted, maintaining the integrity of your financial data.

Our Personalized Budget Worksheet isn't just a static tool; it's a dynamic platform that adapts to your financial needs. With advanced formatting features, you'll experience a level of automation that simplifies budget inputs, saving you time and effort while maintaining accuracy and precision in managing your finances month after month.

FULLY CUSTOMIZABLE**

Introducing the ultimate solution to manage your finances effectively - our Personalized Budget Worksheet with Monthly Tabs! Take control of your expenses, savings, and financial goals like never before with this meticulously designed, user-friendly worksheet. This is a GOOGLE SHEETS download. You will need to utilize a Google Account with this worksheet.

Each month is conveniently organized into separate tabs, allowing you to track and plan your budget with ease. Customizable fields enable you to input your income, expenses, savings targets, and debts, providing a clear snapshot of your financial standing every month.

Key Features:

1. Monthly Tabs: Easily navigate between months to monitor and analyze your finances month-by-month.

2. Customizable Fields: Tailor the worksheet to fit your specific financial situation by inputting your income, expenses, savings, and debts.

3. Comprehensive Tracking: Monitor spending patterns, set achievable saving goals, and track progress towards financial milestones.

4. User-Friendly Design: Simple and intuitive layout for effortless budget planning and management.

5. Personalized Solution: Adapt the worksheet to your unique financial needs and goals.

Our Personalized Budget Worksheet also includes a powerful carry-over feature that ensures seamless budgeting from one month to the next. This feature automatically transfers unspent amounts or overspent categories into the following month’s budget, allowing for more accurate tracking and adjustment of your finances. Whether you have leftover savings or exceeded your budget in certain areas, the worksheet adapts accordingly, ensuring that nothing is missed. This helps you stay on top of your financial goals and provides a realistic view of how your spending and saving habits evolve over time.

Why Choose Our Personalized Budget Worksheet?

- Empowers you to take charge of your finances by providing a clear, organized, and practical budgeting tool.

- Helps you stay accountable and motivated towards achieving financial stability and goals.

- Encourages smart financial decisions by offering a structured overview of your income and expenses.

Whether you're aiming to save for a vacation, pay off debts, or simply gain better control of your finances, our Personalized Budget Worksheet with Monthly Tabs is the tool you need for financial success. Invest in your financial well-being today and experience the peace of mind that comes with effective budget management!

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

Here's how using our worksheet can propel you towards your goals:

1. Clarity and Organization: Gain a crystal-clear understanding of your financial landscape. Categorize and monitor your income and expenses on a month-to-month basis, providing a structured overview of where your money goes.

2. Goal Setting and Tracking: Set achievable financial objectives - be it saving for a down payment, creating an emergency fund, or paying off debts. Our worksheet allows you to set these goals and track your progress over time. Witnessing your accomplishments each month is a powerful motivator.

3. Identifying Saving Opportunities: Pinpoint areas where you can cut unnecessary expenses or allocate more funds toward your goals. Visualizing your spending habits empowers you to make informed decisions about where to save or invest.

4. Budget Optimization: Fine-tune your budgeting strategy based on real-time data. Analyze trends, identify patterns, and make adjustments to ensure you're consistently moving closer to your financial targets.

5. Financial Awareness and Discipline: By regularly updating the worksheet, you cultivate a habit of financial mindfulness. This awareness helps you steer clear of impulsive spending and reinforces disciplined money management.

6. Building Financial Confidence: As you watch your progress unfold, you'll feel more confident and in control of your financial journey. This newfound confidence will drive you towards achieving even loftier financial goals.

By utilizing our Personalized Budget Worksheet with Monthly Tabs, you're not just managing numbers; you're taking deliberate steps towards financial empowerment. The structured approach offered by our worksheet acts as a roadmap guiding you towards financial success. Start your journey today and witness the transformative power of effective financial planning!

Concerned about security and privacy while managing your finances? Our Personalized Budget Worksheet with Monthly Tabs offers a safe and reliable alternative to app-based financial tracking, ensuring complete control without the need to connect to any financial institutions.

Here's why using our worksheet can be a safer way to track your expenses:

1. No External Connections: Unlike apps that often require linking to your bank accounts or financial institutions, our worksheet operates independently. You have full control over your financial data, eliminating any potential security risks associated with external connections.

2. Enhanced Privacy: Your financial information remains strictly within your hands. There's no exposure to third-party apps or external servers, reducing the chances of data breaches or unauthorized access to your sensitive financial details.

3. Offline Accessibility: Our worksheet operates offline, ensuring that your financial information stays secure on your personal device. You won't be dependent on an internet connection or worry about potential vulnerabilities that come with cloud-based services.

4. Customized Security Measures: You can implement your own security measures when using the worksheet, such as password protection or storing it in a secure location. This adds an extra layer of security tailored to your comfort level.

5. Peace of Mind: With no connectivity to external financial systems, you have peace of mind knowing that your financial data is solely in your control. There's no risk of data exposure due to breaches in third-party systems.

Our Personalized Budget Worksheet offers a safe and practical way to manage your finances without compromising on security. By opting for this offline method, you retain complete authority over your financial information, ensuring a secure and private approach to tracking expenses and achieving your financial goals.

Experience seamless and efficient budget management with our Personalized Budget Worksheet featuring advanced formatting capabilities designed to streamline your financial planning effortlessly from month to month.

Here's how our advanced formatting can automate budget inputs:

1. Formula Automation: Forget manual calculations! Our worksheet comes equipped with pre-built formulas that automatically calculate totals, percentages, and averages. Simply input your income, expenses, and savings data in designated fields, and let the worksheet do the math for you.

2. Recurring Expense Templates: Streamline your budgeting process by setting up recurring expense templates. Easily duplicate recurring monthly expenses with a simple copy-and-paste action. This feature saves time by eliminating the need to re-enter the same expenses each month.

3. Dynamic Data Transfer: Link data between tabs or sections within the worksheet. For instance, your total expenses from the previous month can automatically transfer to the following month's budget, providing a seamless continuity in tracking your finances.

4. Conditional Formatting: Set up conditional formatting rules to visually highlight specific criteria. For instance, expenses exceeding a certain threshold can be color-coded to draw attention, ensuring you're aware of significant expenses at a glance.

5. Goal Tracking and Progress Visualization: Utilize progress bars or visual indicators to track your progress towards financial goals. These visual aids offer a clear representation of how close you are to achieving specific milestones, keeping you motivated and focused.

6. Data Validation and Drop-down Menus: Ensure data accuracy and consistency by implementing drop-down menus and data validation. This feature minimizes errors and ensures that only valid inputs are accepted, maintaining the integrity of your financial data.

Our Personalized Budget Worksheet isn't just a static tool; it's a dynamic platform that adapts to your financial needs. With advanced formatting features, you'll experience a level of automation that simplifies budget inputs, saving you time and effort while maintaining accuracy and precision in managing your finances month after month.

FULLY CUSTOMIZABLE**

Introducing the ultimate solution to manage your finances effectively - our Personalized Budget Worksheet with Monthly Tabs! Take control of your expenses, savings, and financial goals like never before with this meticulously designed, user-friendly worksheet. This is a GOOGLE SHEETS download. You will need to utilize a Google Account with this worksheet.

Each month is conveniently organized into separate tabs, allowing you to track and plan your budget with ease. Customizable fields enable you to input your income, expenses, savings targets, and debts, providing a clear snapshot of your financial standing every month.

Key Features:

1. Monthly Tabs: Easily navigate between months to monitor and analyze your finances month-by-month.

2. Customizable Fields: Tailor the worksheet to fit your specific financial situation by inputting your income, expenses, savings, and debts.

3. Comprehensive Tracking: Monitor spending patterns, set achievable saving goals, and track progress towards financial milestones.

4. User-Friendly Design: Simple and intuitive layout for effortless budget planning and management.

5. Personalized Solution: Adapt the worksheet to your unique financial needs and goals.

Our Personalized Budget Worksheet also includes a powerful carry-over feature that ensures seamless budgeting from one month to the next. This feature automatically transfers unspent amounts or overspent categories into the following month’s budget, allowing for more accurate tracking and adjustment of your finances. Whether you have leftover savings or exceeded your budget in certain areas, the worksheet adapts accordingly, ensuring that nothing is missed. This helps you stay on top of your financial goals and provides a realistic view of how your spending and saving habits evolve over time.

Why Choose Our Personalized Budget Worksheet?

- Empowers you to take charge of your finances by providing a clear, organized, and practical budgeting tool.

- Helps you stay accountable and motivated towards achieving financial stability and goals.

- Encourages smart financial decisions by offering a structured overview of your income and expenses.

Whether you're aiming to save for a vacation, pay off debts, or simply gain better control of your finances, our Personalized Budget Worksheet with Monthly Tabs is the tool you need for financial success. Invest in your financial well-being today and experience the peace of mind that comes with effective budget management!

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

"Unlock the pathway to achieving your financial aspirations with our Personalized Budget Worksheet featuring Monthly Tabs. This meticulously designed tool isn't just about tracking expenses; it's a catalyst for realizing your financial dreams.

Here's how using our worksheet can propel you towards your goals:

1. Clarity and Organization: Gain a crystal-clear understanding of your financial landscape. Categorize and monitor your income and expenses on a month-to-month basis, providing a structured overview of where your money goes.

2. Goal Setting and Tracking: Set achievable financial objectives - be it saving for a down payment, creating an emergency fund, or paying off debts. Our worksheet allows you to set these goals and track your progress over time. Witnessing your accomplishments each month is a powerful motivator.

3. Identifying Saving Opportunities: Pinpoint areas where you can cut unnecessary expenses or allocate more funds toward your goals. Visualizing your spending habits empowers you to make informed decisions about where to save or invest.

4. Budget Optimization: Fine-tune your budgeting strategy based on real-time data. Analyze trends, identify patterns, and make adjustments to ensure you're consistently moving closer to your financial targets.

5. Financial Awareness and Discipline: By regularly updating the worksheet, you cultivate a habit of financial mindfulness. This awareness helps you steer clear of impulsive spending and reinforces disciplined money management.

6. Building Financial Confidence: As you watch your progress unfold, you'll feel more confident and in control of your financial journey. This newfound confidence will drive you towards achieving even loftier financial goals.

By utilizing our Personalized Budget Worksheet with Monthly Tabs, you're not just managing numbers; you're taking deliberate steps towards financial empowerment. The structured approach offered by our worksheet acts as a roadmap guiding you towards financial success. Start your journey today and witness the transformative power of effective financial planning!

Concerned about security and privacy while managing your finances? Our Personalized Budget Worksheet with Monthly Tabs offers a safe and reliable alternative to app-based financial tracking, ensuring complete control without the need to connect to any financial institutions.

Here's why using our worksheet can be a safer way to track your expenses:

1. No External Connections: Unlike apps that often require linking to your bank accounts or financial institutions, our worksheet operates independently. You have full control over your financial data, eliminating any potential security risks associated with external connections.

2. Enhanced Privacy: Your financial information remains strictly within your hands. There's no exposure to third-party apps or external servers, reducing the chances of data breaches or unauthorized access to your sensitive financial details.

3. Offline Accessibility: Our worksheet operates offline, ensuring that your financial information stays secure on your personal device. You won't be dependent on an internet connection or worry about potential vulnerabilities that come with cloud-based services.

4. Customized Security Measures: You can implement your own security measures when using the worksheet, such as password protection or storing it in a secure location. This adds an extra layer of security tailored to your comfort level.

5. Peace of Mind: With no connectivity to external financial systems, you have peace of mind knowing that your financial data is solely in your control. There's no risk of data exposure due to breaches in third-party systems.

Our Personalized Budget Worksheet offers a safe and practical way to manage your finances without compromising on security. By opting for this offline method, you retain complete authority over your financial information, ensuring a secure and private approach to tracking expenses and achieving your financial goals.

Experience seamless and efficient budget management with our Personalized Budget Worksheet featuring advanced formatting capabilities designed to streamline your financial planning effortlessly from month to month.

Here's how our advanced formatting can automate budget inputs:

1. Formula Automation: Forget manual calculations! Our worksheet comes equipped with pre-built formulas that automatically calculate totals, percentages, and averages. Simply input your income, expenses, and savings data in designated fields, and let the worksheet do the math for you.

2. Recurring Expense Templates: Streamline your budgeting process by setting up recurring expense templates. Easily duplicate recurring monthly expenses with a simple copy-and-paste action. This feature saves time by eliminating the need to re-enter the same expenses each month.

3. Dynamic Data Transfer: Link data between tabs or sections within the worksheet. For instance, your total expenses from the previous month can automatically transfer to the following month's budget, providing a seamless continuity in tracking your finances.

4. Conditional Formatting: Set up conditional formatting rules to visually highlight specific criteria. For instance, expenses exceeding a certain threshold can be color-coded to draw attention, ensuring you're aware of significant expenses at a glance.

5. Goal Tracking and Progress Visualization: Utilize progress bars or visual indicators to track your progress towards financial goals. These visual aids offer a clear representation of how close you are to achieving specific milestones, keeping you motivated and focused.

6. Data Validation and Drop-down Menus: Ensure data accuracy and consistency by implementing drop-down menus and data validation. This feature minimizes errors and ensures that only valid inputs are accepted, maintaining the integrity of your financial data.

Our Personalized Budget Worksheet isn't just a static tool; it's a dynamic platform that adapts to your financial needs. With advanced formatting features, you'll experience a level of automation that simplifies budget inputs, saving you time and effort while maintaining accuracy and precision in managing your finances month after month.